When it comes to getting paid, understanding your pay schedule is important. Whether you are an employee checking your paycheck or an employer setting up payroll, knowing how many pay periods are in a year helps with budgeting, planning, and managing your finances.

In this article, we will explain everything you need to know about pay periods—what they are, how many there are in a year, and how different pay schedules work.

What Is a Pay Period?

A pay period is the length of time during which an employee works and earns wages. At the end of each pay period, employees receive a paycheck for the work they’ve completed.

For example, if your company pays you every two weeks, each two weeks is considered a pay period.

Why Are Pay Periods Important?

Pay periods are important because they:

- Help employees know when to expect their pay.

- Make it easier for businesses to run payroll regularly.

- Help with financial planning and budgeting.

- Determine how often taxes and deductions are calculated.

Types of Pay Periods

There are several types of pay periods that companies use. Each has a different number of pay periods per year.

Let’s break them down.

1. Weekly Pay

- How it works: Employees are paid once a week.

- Number of pay periods in a year: 52

Since there are 52 weeks in a year, employees paid weekly receive 52 paychecks per year.

Example: If you get paid every Friday, you’ll receive 52 paychecks annually.

Pros:

- Great for cash flow.

- Easier for hourly workers to track hours and pay.

Cons:

- More payroll processing for employers.

2. Biweekly Pay

- How it works: Employees are paid every two weeks.

- Number of pay periods in a year: 26 (sometimes 27)

There are usually 26 biweekly pay periods in a year. This is because there are 52 weeks in a year, and 52 divided by 2 equals 26.

However, depending on how the calendar falls, some years have 27 pay periods. This happens about once every 11 years.

Example: If you get paid every other Friday, you’ll typically receive 26 paychecks per year, but in rare cases, you might get 27.

Pros:

- Balanced frequency between weekly and monthly.

- Easier for budgeting.

Cons:

- An extra pay period in some years can affect salary budgeting.

3. Semimonthly Pay

- How it works: Employees are paid twice a month, typically on the 15th and last day of the month.

- Number of pay periods in a year: 24

Unlike biweekly pay, semimonthly pay always gives you 24 paychecks per year—two each month.

Example: You might be paid on the 15th and 30th (or 31st) of every month.

Pros:

- Predictable pay dates.

- Matches monthly billing cycles.

Cons:

- Uneven weeks can make time tracking more difficult.

- Paydays can fall on weekends or holidays.

4. Monthly Pay

- How it works: Employees are paid once a month.

- Number of pay periods in a year: 12

Monthly pay gives employees 12 paychecks per year, one for each month.

Example: You might get paid on the last working day of every month.

Pros:

- Fewer payroll runs for employers.

- Matches monthly expenses like rent or loans.

Cons:

- Harder for employees to budget.

- Long gaps between paychecks.

Summary: Pay Periods Per Year

Here’s a quick summary of how many pay periods each schedule has:

| Pay Schedule | Pay Periods/Year | Notes |

|---|---|---|

| Weekly | 52 | Paid every week |

| Biweekly | 26 (sometimes 27) | Paid every 2 weeks |

| Semimonthly | 24 | Paid twice per month |

| Monthly | 12 | Paid once per month |

Which Pay Period Is Best?

There is no one-size-fits-all answer. The best pay schedule depends on your business needs and employee preferences.

For Employers:

- Weekly or biweekly is better for hourly workers.

- Semimonthly or monthly is better for salaried employees and reduces payroll costs.

For Employees:

- More frequent pay (weekly or biweekly) makes it easier to manage daily expenses.

- Less frequent pay (semimonthly or monthly) may require better budgeting.

What About Leap Years?

Leap years don’t usually affect the number of pay periods unless your schedule is biweekly. In some leap years, a 27th biweekly pay period might occur. This can affect salaried workers because their annual salary is usually divided evenly across 26 pay periods.

In a year with 27 pay periods, employers may need to:

- Adjust the per-paycheck salary amount.

- Keep the same amount per check but give an extra payment.

How to Calculate Your Annual Pay Based on Pay Periods

If you’re trying to figure out your yearly income based on your paycheck, here’s how to calculate it:

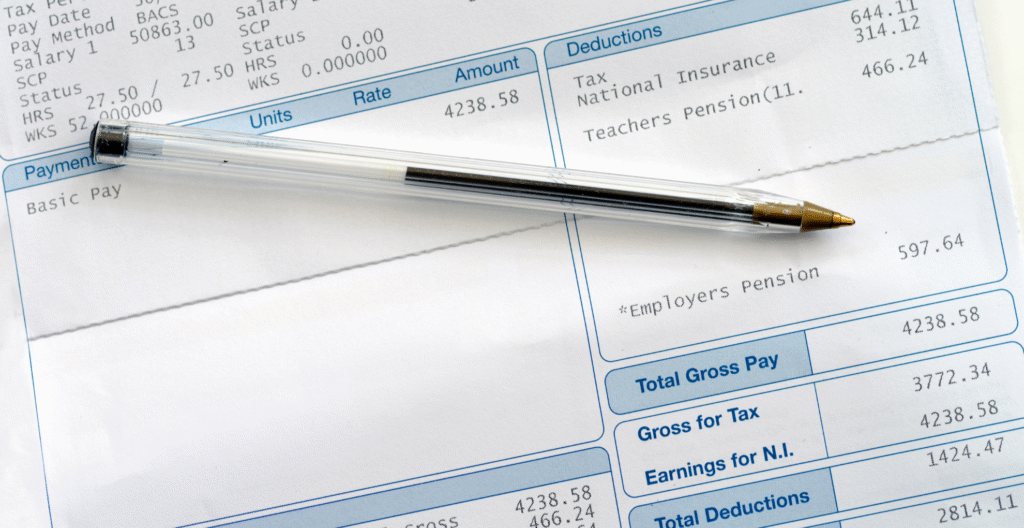

Step 1: Find your gross pay per paycheck (before taxes).

Step 2: Multiply by the number of pay periods.

Examples:

- Weekly: \$800 x 52 = \$41,600 per year

- Biweekly: \$1,600 x 26 = \$41,600 per year

- Semimonthly: \$1,733.33 x 24 = \$41,600 per year

- Monthly: \$3,466.67 x 12 = \$41,600 per year

As you can see, your total yearly income stays the same—it’s just divided differently.

How to Choose the Right Pay Schedule for Your Business

If you’re an employer, here are some things to consider:

- State laws: Some states have rules about how often employees must be paid.

- Employee type: Hourly workers may prefer weekly or biweekly pay.

- Payroll processing costs: More frequent pay periods mean more payroll runs.

- Cash flow: Make sure your business can handle regular payroll expenses.

- Industry standards: Follow what others in your field are doing.

How Extra Pay Periods Can Affect Your Paycheck

If you’re paid on a biweekly schedule, you’ll usually receive 26 paychecks per year. However, every few years, the calendar lines up in such a way that you receive 27 paychecks instead. This happens because 52 weeks ÷ 2 weeks = 26. But there are 52 weeks and 1 day in a typical year (or 2 days in a leap year), which adds up over time.

What This Means for Employees

If you’re a salaried employee, your employer may:

- Divide your annual salary by 27 instead of 26, resulting in slightly smaller checks, or

- Keep your paycheck amount the same and just give you an extra paycheck for that year.

It’s important to ask your HR or payroll department how they handle it. That way, you can plan your budget accordingly.

Impact on Employers and Payroll Systems

For businesses, choosing a pay schedule affects more than just employee satisfaction. It has an impact on:

- Payroll processing time

- Administrative costs

- Compliance with labour laws

Payroll Processing Frequency

- Weekly and biweekly schedules require payroll teams to process wages more often, which means more time and higher costs.

- Semimonthly and monthly pay periods reduce that workload, but may be more difficult for tracking hours accurately, especially for hourly workers.

Legal Considerations for Pay Periods

In the U.S., each state has its own labour laws that may limit how infrequently employees can be paid. Some states require at least semi-monthly pay, while others allow monthly pay in certain industries.

Employers must always:

- Follow state wage laws

- Provide accurate pay stubs

- Pay employees on a consistent, published schedule

Failing to do so could lead to penalties or lawsuits.

Tips for Employees: Managing Your Paychecks

No matter how often you’re paid, managing your money wisely is key. Here are a few tips:

- Create a budget based on your pay schedule.

- Use apps or spreadsheets to track when bills are due.

- Save a portion of each paycheck for emergencies.

- Watch for months when you may receive an extra check (e.g., three biweekly paydays in one month).

Being aware of your pay period schedule helps you avoid surprises and manage your financial life more smoothly.

Final Thoughts about Pay Periods

Understanding how many pay periods are in a year is more than just knowing how often you get paid. It helps you plan, budget, and manage your finances better. Whether you’re paid weekly, biweekly, semi-monthly, or monthly, the key is to understand your pay schedule and how it fits into your financial goals. Would you like a downloadable infographic or a printable version of this article?