Payroll correction is an important part of managing payroll, ensuring employees are paid correctly and on schedule. Payroll, the process of calculating and disbursing pay, is an essential component of any firm. Small business owners frequently handle payroll alone, whilst larger organizations rely on specialist HR teams or outsourced services.

Payroll management becomes more challenging when firms expand abroad. This complexity raises the possibility of payroll errors. Therefore, the payroll adjustment procedure is crucial. Companies that resolve issues swiftly can maintain employee satisfaction and payroll compliance. Using current, automated techniques makes the correcting process simpler, more efficient, and more accurate.

Understanding Payroll Correction

Errors in payroll management are unavoidable, but understanding payroll correction is the first step toward reducing them. Simply put, payroll correction detects and addresses errors in worker compensation. These inconsistencies can occur for various reasons, including improper data entry, miscalculations, or software errors.

Payroll correction differs from regular payroll processing. Unlike ordinary payroll runs, a payroll correction recalculates previous quarters to correct errors. This technique corrects prior payments and produces a rectified payroll result. Payroll compliance is quite important in this setting. Ensuring that corrections follow tax laws and labor standards reduces legal risk. Uncorrected errors can cause staff discontent and even legal problems. By prioritizing payroll correction, businesses can foster a reliable and compliant payroll system.

Why is Payroll Correction Important?

Payroll correction is more than just repairing errors; it is a basic prerequisite for corporate success. These errors can cause serious problems, ranging from legal penalties to low employee morale. Payroll compliance is extremely important in foreign businesses. Errors in tax deductions or employee classifications might result in significant fines or penalties. Furthermore, unsolved payroll problems can tarnish a company’s reputation, making it difficult to retain and recruit talented individuals.

Payroll errors erode trust among employees. For example, underpaid employees may feel unappreciated, whereas overpaid employees may experience repayment issues. Long-term payroll errors may increase employee turnover and lead to lawsuits. As a result, swiftly correcting payroll inconsistencies saves the organization from legal issues while also maintaining a healthy work atmosphere. Companies that implement proper payroll rectification techniques can assure equal treatment for all employees while remaining compliant with rules.

Common Payroll Errors and Discrepancies

Payroll errors, while common, can have long-term ramifications if not handled. The following are some common mistakes that require payroll adjustment and techniques to avoid them:

Incorrect employee information

Outdated or incorrect employee information, such as tax codes or bank account numbers, might cause payroll issues. For example, an inaccuracy in bank account information can cause direct deposits to be delayed, resulting in dissatisfaction. To avoid this, organizations should constantly check and update records on company employees.

Pay Miscalculations

Wage, overtime, and bonus calculation errors can have a major impact on employees. For example, failure to account for overtime hours results in underpayment. On the other side, excessive deductions can irritate personnel. A substantial review procedure, aided by payroll software, reduces these errors.

Employee Misclassification

Misclassifying workers, such as treating contractors as full-time employees, might result in tax liabilities. Clear employment contracts that define roles and obligations are crucial. These contracts ensure that local labor regulations are followed and that there is less danger of misclassification.

Withholding Mistakes

Errors in withholding taxes, benefits, or insurance premiums are among the most prevalent difficulties that require payroll correction. For example, over-withholding taxes might irritate employees, whereas under-withholding can result in penalties. Keeping up with tax requirements and employing automation tools helps prevent such mistakes.

How to Fix Payroll Issues

When payroll inconsistencies develop, swiftly resolving them is critical to maintaining compliance and employee trust. Here’s a step-by-step guide to completing payroll correction effectively:

1. Identify the problem

The first step is to determine the root cause of the error. Common concerns include out-of-date software, incorrect timesheets, and misreported hours. Pinpointing the source ensures that the remediation process addresses the correct issue.

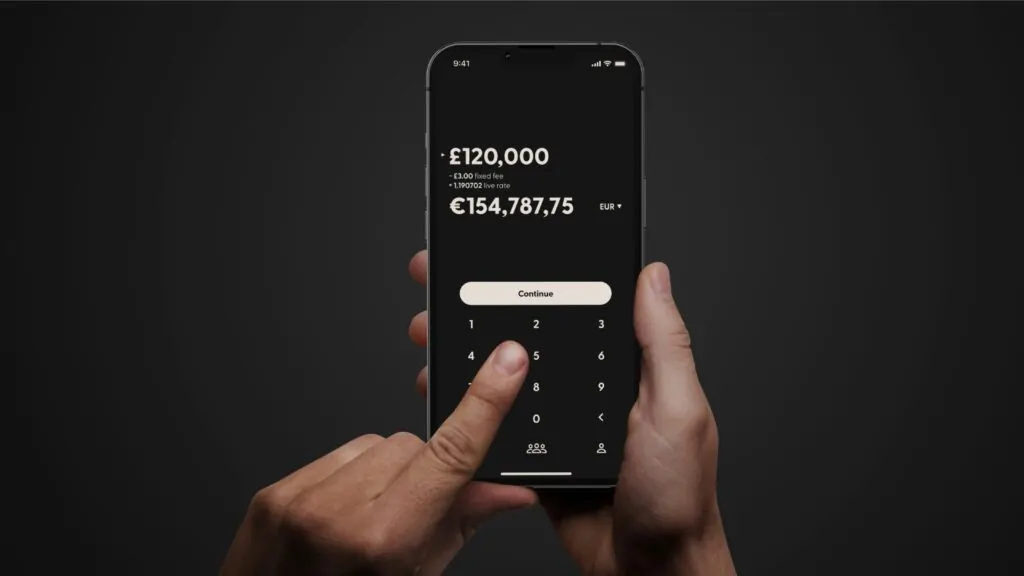

2. Use Payroll Management Tools

Using trustworthy payroll administration software can help to streamline the correction process. These technologies help you reduce errors, maintain payroll compliance, and simplify calculations. Additionally, mobile-friendly technologies improve accessibility for HR and payroll teams.

3. Verify employee classification

Confirm that employees are properly classified as exempt, non-exempt, full-time, or part-time. Misclassification frequently leads to payroll problems, particularly in companies with foreign teams.

4. Review the hours worked

Accurate timesheets are critical. To avoid mistakes, double-check all hours worked, including overtime. A robust time-tracking system can help ensure accuracy.

5. Stay up to date on regulations

Payroll regulations vary by region and are constantly updated. Keeping up with these modifications is critical for preventing compliance mistakes throughout payroll processing.

6. Audit Payroll Reports

Before making any final payments, thoroughly study the payroll reports. Look for anomalies in pay rates, personnel classifications, and deductions.

7. Process Payroll with Care

Once all corrections have been verified, run payroll through updated software. Training employees on compliance and best practices ensures errors are less likely to occur in the future.

Communicating Payroll Corrections

Effective communication is essential when dealing with payroll errors. Miscommunication can cause confusion, delays, and even resentment among staff. To speed the process, firms should prioritize clear and consistent messaging throughout teams and employees.

Increase Collaboration between Payroll and HR

Strong communication between payroll and HR departments ensures that payroll corrections are accurate and timely. HR staff should give real-time updates on new hiring, role changes, and employee status changes. Meanwhile, payroll teams should communicate forthcoming processing deadlines, corrective timetables, and compliance updates.

Notify Employees Clearly

When a payroll adjustment affects an employee’s salary, notify them right away. Explain the problem, its cause, and the corrective activities being implemented using straightforward and empathic language. Provide a timeline for the resolution and be open to answering questions. Transparency builds trust and minimizes frustration.

Use Technology to Improve Communication

Implement payroll software with built-in communication tools to make the process more efficient. Many systems enable employees to check their pay information, report discrepancies, and monitor the status of fixes. These features save time and provide clarity for all parties involved.

Preventing Payroll Problems

While payroll correction is vital, avoiding errors altogether is significantly more efficient. Proactively resolving possible concerns provides easier operations and increases employee trust in your payroll system.

- Automate Payroll Processes: Manually managing payroll raises the possibility of errors. Using current payroll software reduces errors by automating calculations, tax deductions, and compliance checks. Many solutions also provide real-time reporting, which makes it easier to detect inconsistencies before they worsen.

- Conduct Regular Payroll Audits: Audits are critical for ensuring payroll compliance and identifying any issues. Conduct routine checks to confirm employee categories, pay rates, hours worked, and tax withholdings. Any anomalies should be addressed immediately to avoid future issues.

- Staff should be trained continuously: Payroll systems and rules regularly change. Payroll and HR workers receive regular training to ensure they are up to date on best practices, software tools, and legal needs. A well-trained crew is less likely to make mistakes and can handle payroll adjustments quickly when necessary.

- Update employee records frequently: Outdated employee information is the root cause of many payroll mistakes. Create a system for frequently verifying and updating personal information, tax returns, and bank accounts. Accurate records are the cornerstone for efficient payroll processing and compliance.

- Establish clear policies: Make sure your payroll policies are well documented and shared with employees. Explain the procedures for reporting problems, filing timesheets, and resolving disputes. Clear policies eliminate misunderstandings and give employees more confidence in your operations.

Conclusion

Payroll correction is critical for proper employee remuneration, guaranteeing payroll compliance, and building confidence within an organization. Businesses can reduce errors and associated risks by employing proactive measures such as process automation, auditing, and communication improvement. For companies struggling with complex payroll management, EOR Services UK offers invaluable support. The experts at our firm handle everything from processing payroll corrections to ensuring compliance with tax laws and labor regulations. Lastly, our experience enables firms to save time, decrease errors, and focus on growth.

FAQs

Ignoring payroll errors can result in legal consequences including fines or lawsuits, as well as lower employee morale. Over time, these difficulties may lead to higher turnover and reputational damage.

Payroll audits should be performed at least quarterly to verify payroll compliance and detect potential problems. Audits regularly help to keep accurate records and limit the probability of severe discrepancies.

To fix a payroll error, the employer must review the error, compute the correct compensation, and deliver any necessary adjustments to the employee. It is also critical to contact the employee and ensure that the fix is implemented in the next payroll cycle.